Workstream 4: Collaborative Network

Foster collaborations to drive the development of Climate and Disaster Risk Finance and Insurance solutions through well-established networking and management of information

InsuResilience Annual Forum 2020

4th InsuResilience Global Partnership Annual Forum - Summary Report

The InsuResilience Annual Forum is the global flagship event of the climate and disaster risk financing community bringing together members of the InsuResilience Global Partnership, and the wider resilience community, to exchange knowledge on lessons learnt, best practice and innovations. Due to the Covid-19 pandemic, the Partnership Annual Forum was organised as a 4-day virtual event from 7th – 10th December 2020. The Forum featured seven sessions of two hours each with a total attendance of 1,076 persons including four side events hosted by members of the Partnership.

Under the theme “Protecting development in a changing climate risk environment”, the fourth Annual Partnership Forum provided a platform for an open discussion on the compounding effect of the Covid-19 pandemic and climate threats on poor and vulnerable communities. The discussions triggered reflection on the potential of Climate and Disaster Risk Finance and Insurance (CDRFI) solutions to support the implementation of response measures required for immediate risk and crisis management, including pandemics.

Discussion over the four days revolved around the notion on how to preserve development gains through strategic collaboration, anticipatory action and designing climate and disaster risk management instruments that are fit for purpose.

Day 1: High Level Event: From strategy to implementation – deliverables on the road to Vision 2025

In a video message to open the session, Hon. Alfred Alfred Jr., Minister of Finance of the Republic of Marshall Islands and the V20 Co-Chair of the High-Level Consultative Group (HLCG) of the Partnership, underlined the severity of the strain the Covid-19 pandemic places on V20 countries amidst the risks of flooding, typhoons, and hurricanes they are exposed to: “Proactive investments in risk analysis and risk reduction, including in early warning systems and digital infrastructure, as well as in risk transfer mechanisms such as social protection, can allow to combine responses to the pandemic and climate impacts; and thus, maximise their cost-effectiveness in light of scarce resources.”

Dr. Maria Flachsbarth, Parliamentary State Secretary, Federal Ministry for Economic Cooperation and Development, Germany, and G20 Co-Chair of the HLCG, in her address, reiterated the significant role of CDRFI in safeguarding development gains and building the needed resilience of vulnerable communities.

Dr. Flachsbarth added, “The High-Level Consultative Group also decided to drive forward the systemic integration of risk finance into national adaptation planning, into countries’ updates of their Nationally Determined Contributions under the Paris Agreement.”

The session provided the platform for the soft launch of the InsuResilience Centre of Excellence for Gender-smart Solutions by the high-level Co-Chairs of the InsuResilience Gender Working Group, Patricia Fuller, Canada’s Climate Ambassador and Sofia Sprechmann Siniero, Secretary General of CARE International.

“The High-Level Consultative Group also decided to drive forward the systemic integration of risk finance into national adaptation planning, into countries’ updates of their Nationally Determined Contributions under the Paris Agreement.”

Dr. Maria Flachsbarth, Parliamentary State Secretary, Federal Ministry for Economic Cooperation and Development, Germany, and G20 Co-Chair of the HLCG

“Proactive investments in risk analysis and risk reduction, including in early warning systems and digital infrastructure, as well as in risk transfer mechanisms such as social protection, can allow to combine responses to the pandemic and climate impacts; and thus, maximise their cost-effectiveness in light of scarce resources.”

Hon. Alfred Alfred Jr., Minister of Finance of the Republic of Marshall Islands and the V20 Co-Chair of the High-Level Consultative Group (HLCG) of the Partnership

“The SIF aims to mobilise international finance and technical assistance. The objective is to stimulate climate-smart insurance offerings by domestic and regional insurers to protect MSME’s and the poor and vulnerable that rely on them.”

Secretary Maybelline Andong Bing, Ministry of Finance of the Republic of Marshall Islands

The session’s climax was a discussion on lessons from the Tripartite Agreement and Global Risk Financing Facility implementation with key innovations as essential steps to reaching the Partnership’s Vision 2025. The panelists discussed the need for an enabling environment for smart market creation and insurance regulation in vulnerable countries including the potential of artificial intelligence and risk analytics for developing effective disaster risk models and systems. They emphasised the need for strategic collaborations that develop local capacities and response mechanism for vulnerable countries. The high-level panelists identified a long-term collaborative engagement, pre-arranged flexible finance and the inclusion of different relevant stakeholders within a country as key success factors.

Secretary Maybelline Andong Bing, Ministry of Finance of the Republic of Marshall Islands, shared with the attendees the significance of Micro, Small & Medium Enterprises (MSMEs) to the socioeconomic development of Small Island Developing States (SIDS) and the potential of MSMEs as leverage areas for resilience building. Speaking on the V20 led Sustainable Insurance Facility (SIF), she added: “the SIF aims to mobilise international finance and technical assistance. The objective is to stimulate climate-smart insurance offerings by domestic and regional insurers to protect MSME’s and the poor and vulnerable that rely on them.”

The session concluded with a panel interview on how disaster risk approaches could be structured, aligned and layered to improve the resilience of vulnerable countries. Assistant Secretary Paola Alvarez, of the Department of Finance, Philippines, showed how the Philippine government structured an effective layered risk finance approach to cover a wider variety of risks.

Within this context, the African Risk Capacity (ARC) collaborates with African governments to plan, prepare and respond to climate-related extreme events. Under this approach Mr. Ibrahima Diong, United Nations Assistant Secretary-General and Director-General of African Risk Capacity Group, stated that ARC programmes had assisted over 2 million vulnerable people across Africa.

Speaking on the opportunities to support climate-vulnerable countries in the next European Union Multiannual Financial Framework, Stephano Signore, Head of Unit Sustainable Energy and Climate Change pointed out that the EU is translating the ambitions of the Green Deal together with the Covid-19 response to support partner and vulnerable countries in their effort towards more resilient climate infrastructure and sustainable economies.

Day 2: Interactive Solution-Building - Decision-Making under Uncertainty in a Changing Multi-Hazard Climate and Disaster Risk Environment

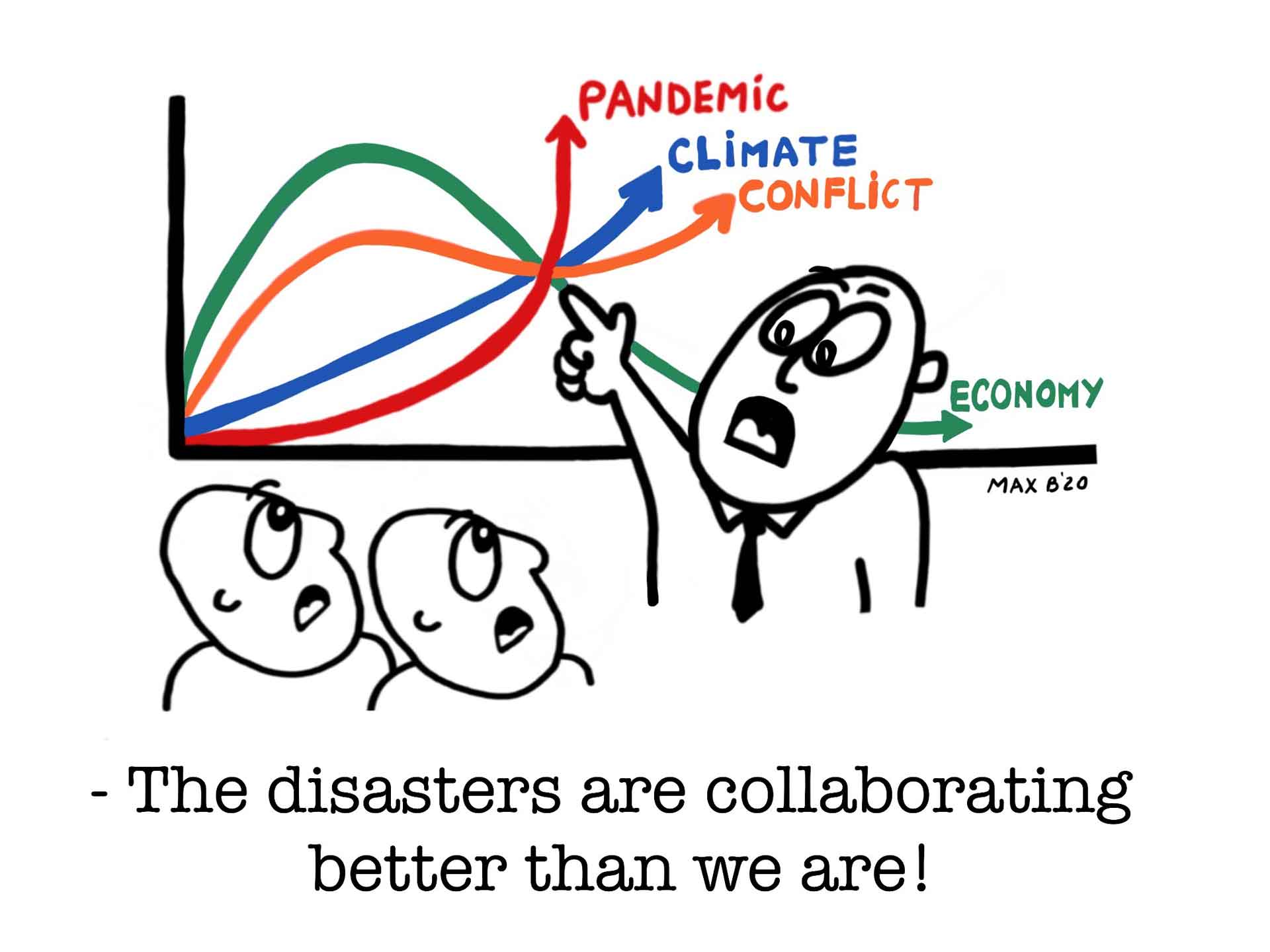

On Day 2 of the Partnership Forum, participants were engaged in an interactive session to reflect on the changing risk environment and how actors in the climate risk finance space can harness lessons, expertise and innovations to develop resilience and preparedness towards the climate risks as well as disasters like the Covid-19 pandemic. It was highlighted that it is important to understand the intersection of multi-hazards and the role of CDRFI solutions in addressing compound risks.

To set the tone for the session, Ekhosuehi Iyahen, Secretary-General, Insurance Development Forum (IDF) presentated a drawing from IDF’s latest report “The Development Impact of Risk Analytics.” She reinforced the need for risk understanding as a prerequisite for sustainable development and resilience building. Risk analytics provide the basis for better decision-making and establishing strategic collaborations and partnerships that foster innovative approaches to assessing and addressing a risk at all levels.

Zoe Scott, Head of Multilateral Programmes, Centre of Disaster Protection emphasised the need for a fundamental system change to disaster response. The Covid-19 experience and lessons from our response measures present an opportunity to reflect and shift the compartmentalised approach to preparedness and more integrated and comprehensive risk management.

She said, “the fact that we are beginning to talk about multi-hazard risks is a positive sign that we are evolving as a disaster risk community.”

She pointed out the need to set global targets for pre-arranged crisis finance that ensure disaster risk finance is available when needed most and to those who need it most. Furthermore, she suggested a global surveillance system that could harness and access risk management approaches.

Participants were inspired and triggered into reflection using two creative engagement approaches: Humor-infused interactions and crafting ‘headlines’ about plausible futures. Humor and journalism offer a universal language and mirror our complex world, helping to spark discovery, dissolve denial, and start figuring out what to do. Pablo Suarez of the Red Cross Crescent Climate Centre guided participants through exercises to co-create awareness and explore ways to confront climate and disaster risks management through cartoons and headlines.

In a digital cartoon gallery created specifically for this session, participants were invited to view and annotate a selection of cartoons relevant to the theme of the Forum “Protecting development in a changing climate risk environment.” Participants afterwards assumed the role of time-travelling reporters and were asked to create headlines of plausible futures, including “Good News” (attention-grabbing, realistic optimism) and “Bad News.” The essence of the co-creation process was to distil the challenges of cross-cutting collaboration to manage compound risks and highlight the need for innovative approaches for implementing solutions.

The headlines and annotations were captured in new cartoons by a group of professional cartoon artist. The new cartoons were created to inspire critical reflection and meaningful dialogue. (see Annex for all cartoon sketches created from the session)

The session concluded with a panel reflecting on the participants’ insights and contributions, through the headlines and reactions on how actions and lessons of the Covid-19 pandemic can be harnessed to improves our disaster preparedness in a changing multi-hazard risk environment.

“…while designing a finance mechanism, talk to the communities, talk to what kind of assistance is needed and when is best…the more we can hear from the voices on the ground, the better we can design our instruments” – Kamal Kishore, Member of the National Disaster Authority, India

Day 3: Regional Learning

The focus of Day 3 was to provide a platform to share regional experiences and networking between experts and initiatives within particular regions. There were four sessions dedicated to countries in Asia, Africa, Latin America and the Caribbean and Pacific Regions. The sessions presented the risk finance architecture of Vietnam, Kenya, Peru and Fiji and provided a platform for knowledge exchange on the country case studies of applied and innovative comprehensive climate and disaster risk finance strategies.

The Asian region session presented, inter alia, insights into the agricultural risk financing components of Vietnams climate adaptation strategies. Dr Nguyen Thi Dieu Trinh, Deputy Director General of Vietnam’s Ministry of Planning and Investment, shared with participants Vietnam’s efforts and institutional arrangements to address climate change. Some initiatives connected to Vietnam’s risk finance and adaptation strategies include Agricultural Insurance schemes, The National Disaster Protection Fund and the Risk Sharing Facility. Additionally, projects like the Climate Services for Infrastructure Investments (CSI) by the GIZ supports Vietnam with risk data, information and assessments for infrastructure planning and climate risk management.

Programmes and initiatives like the United Nations Development Programme’s Insurance and Risk Finance Facility and InsuResilience Solution Fund offer support to stakeholders seeking to conduct specific climate risk analysis or launch insurance products in collaboration with government counterparts. Annette Detken, Head of InsuReslience Solutions Fund (ISF), presented insights of the ISFs climate risk analysis on the City of Hue in Vietnam. The study quantifies current and future risks using tools developed by the insurance industry (CLIMADA Platform) to investigate, assess and recommend climate risk management options for policymakers. The study revealed the potential of climate risk insurance to account for and cover the existing gap in the risk that cannot be addressed by physical adaptation measures.

Vietnam has significant experience applying insurance mechanisms, especially in the agricultural sector. The country is restructuring its insurance market intending to introduce new technologies and increase insurance penetration.

With the private sector already supporting the agricultural insurance programs, Vietnam can leverage more private sector engagement to integrate new technologies and risk modelling expertise and enhanced risk analytics to improve insurance products and planning public infrastructure investments.

The African region session highlighted the alignment of different climate and disaster risk finance strategies and stakeholder engagement in Kenya.

Sunya Morongei Orre, Director, National Drought Management Authority presented Kenya’s disaster risk profile, including droughts, seismic shocks and volcanic activity and locust infestations. Kenya also has an elaborated layered disaster risk financing strategy, including sovereign contingent financing, a sovereign risk transfer by being part of the African Risk Capacity, and several risk transfer programs in agricultural insurance, for example, the Kenya Livestock Insurance Program.

Kenya’s strategic approach was to create the enabling environment and crowd in the private sector and donor expertise and financial resources to mobilise resources towards climate and disaster response. In doing so, the government reserves it contingency funds for immediate and rapid disaster response, like the Covid-19 pandemic.

The Disaster Risk finance strategy adopted by the Ministry of Finance of Kenya proves to be an effective instrument for risk finance coordination. Ensuring that the national treasury was placed centrally in the risk financing architecture ensures a convening power that assembles all sectors affected by climate and disaster risk to discuss how to address disaster risk and the appropriation of a budget for set interventions.

Kenya has made significant progress in adopting risk retention and transfer solutions, and further investment is needed to develop resilience at the community level. It is important to engage local communities and individuals to build awareness and develop their knowledge about insurance schemes’ benefits. Furthermore, this close engagement fosters trust and creates the needed platform to gather knowledge from the locals’ towards designing and developing relevant and targeted insurance solutions.

In the third session, discussions revolved around how to operationalise risk finance instruments in Peru. Peru has a National Plan for Disaster Risk Management with public and private entities working together to provide insurance programs throughout the country to compensate and cover disaster risks. The last years have seen an increase in insurance portfolios to match the level of exposure Peru faces. As part of a new methodology for estimating loss and damage, significant improvements have been made, including incorporating tsunami risk and other risk modelling factors to reflect Peru’s risk exposure and developing a software (DAMARIS) to estimate and calculate risk metrics by applying the new methodologies to the insurance portfolios.

This innovative software’s success will be reliant on the access to precise risk data and strategic Public-Private Partnerships to expand insurance to households and develop insurance of public assets.

The last session of the day presented Fiji’s comprehensive climate and disaster risk finance strategy with further deliberations into how to foster collaboration among regional risk pools and how to ensure that insurance solutions are designed to cater and cover the needs of MSME’s.

Dr. Michael Hagenlocher of the United Nations University-Institute for Environment and Human Security (UNU-EHS) opened the session with a presentation to launch the report Disaster Risk and Readiness for Insurance Solutions in Small Island Developing States (SIDS). The report accesses the exposure of the 38 SIDS to 7 identified climate hazards and the readiness of countries for climate risk insurance solutions.

The session continued with an overview of Fiji’s climate and disaster risk profile and strategy to Climate and Disaster Risk Financing by Vineil Narayan, Acting Head of Division and Climate Finance Specialist, Climate Change and International Cooperation Division, Ministry of Economy. Despite the Disaster Risk Reduction, policies, plans, and strategies in place, Fiji’s Government face a disproportionate fiscal resource burden to address climate and disaster risk.

The compounding impact of tropical cyclone activities and the Covid-19 pandemic meant a considerable decline in GDP and a regress in development gains in Fiji and other Pacific countries. The fiscal capacities of governments were significantly stretched under the emerging dilemma of addressing both crises.

In the context of climate and disaster risk and the pandemic response, the Asian Development Bank offered contingent disaster risk financing to eight Pacific member countries and this financing will be scaled up.

Significant learnings from the session were:

- Ownership and understanding of risk and risk models in vulnerable countries should be encouraged.

- The availability and access to risk data are critical for policy decisions.

- Promote and integrate gender considerations and gender policies in financial and insurance mechanisms.

- Developing the institutional capacity to establish comprehensive risk layered approaches is a process and takes time.

- It is crucial to understand better the peculiar needs and the diverse risk environment of Small Island Development States to provide well-tailored CDRFI solutions.

Day 4: Presenting Evidence on how Climate and Disaster Risk Finance and Insurance Impacts Lives

This day focused on how to measure the impact of risk finance solutions. The session presented the monitoring and evaluation strategy of the InsuResilience Global Partnership as framing for discussions on gaps and success factors that limit or contribute to achieving more significant impact within CDRFI projects.

Key outcomes from this session were:

- Develop local partnerships and capacitiesto own risk management strategies is essential to sustainable resilience building in vulnerable communities.

- Design multi-and interdisciplinary research collaborations appealing to different stakeholders, including implementers and academia.

- Monitoring and evaluation frameworks should be adaptive to the complexity of the contexts in which they are used.

- Foster strategic partnerships within regions that ensure judicious use of resources and avoiding redundancies.

To conclude the session, Dr Astrid Zwick, Head of the InsuResilience Secretariat, presented an outlook for the Partnership in 2021. According to her, the pandemic presents an opportunity window to review and revise the multi-dimensional view on risk in CDRFI practice. The endorsement of the five Action Areas by the High-Level Consultative Group of the Partnership empowers the Partnership to enhance in-country adaptation and resilience. In 2021, the Partnership will engage with the NDC Partnership and the NAP Global Network to channel risk financing capabilities and solutions into in-country climate action.

Dr Zwick closed the Forum reiterating the importance of effective collaborative partnerships – a reference to one of the cartoons of Day 2 – being carried as a key recommendation across the entire Forum sessions.

“Developing several frameworks, instruments, knowledge and strategies without the accompanying strategic partnerships will make our vision of protecting poor and vulnerable communities unattainable.”

Recording: Impacting Lives, Part 1; Part 2

More information on the Annual Forum website (full agenda, overview of speakers etc.).