Workstream 2: Action & Implementation

Enable effective action and implementation of high-quality Climate and Disaster Risk Finance and Insurance solutions in poor and vulnerable countries

World Food Programme – Guatemala

Building resilience of the most vulnerable and food insecure populations in Guatemala through a holistic and risk-layered approach

By the World Food Programme

The Latin America and Caribbean (LAC) region is exposed to different shocks threatening communities’ livelihoods and food security. Building the resilience of the most vulnerable and food insecure is a priority for the World Food Programme (WFP), with risk financing playing an important role. WFP LAC has adopted a Risk Financing Strategy to enable incorporation of inclusive risk finance into sustainable and scalable policies, programmes and partnerships through innovative approaches. Inspired by this regional strategy, WFP Guatemala is currently adopting a layered approach where the complementarity between microinsurance, forecast-based financing (FbF), and macro and meso risk financing tools is at the core.

Country Background

2020 clearly showed the challenges of LAC, with countries experiencing a combined impact of the Covid-19 pandemic¹ while at the same time major weather events including Tropical Storm Amanda and Hurricanes Eta and Iota.

Specifically, Guatemala is highly exposed to extreme shocks and its population is very vulnerable to the effects of such events. Increasing frequency and intensity of droughts, as well as excessive rains, severe flooding and landslides, have led to chronic food insecurity in recent years, with the Covid-19 crisis exacerbating the situation.

¹ A major crisis that is leading to the most severe contraction in the region’s historical economic activity.

Unfortunately, poor households, small and micro-entrepreneurs and smallholder farmers are particularly vulnerable to these shocks, with a greater chance of suffering heavy losses while also having very limited access to suitable risk-management tools. WFP recognizes that inclusive risk finance can play a substantial role in building the resilience of the vulnerable groups in cost-effective and timely ways. They also need to be able to increase their access to innovative financial instruments by applying a risk-layered approach that encompasses the micro-, meso- and macro-levels.

¹ A major crisis that is leading to the most severe contraction in the region’s historical economic activity.

Project description

WFP is in a privileged position to unlock access to risk-financing instruments that can directly and indirectly benefit the most vulnerable and food insecure because it has been working with these populations for a long time, alongside government partners. It can also broker the necessary relationship with private-sector players. WFP constantly adopts innovative approaches to reach vulnerable populations, including shock-responsive social protection, the use of cash transfers, community-level disaster risk reduction interventions, food systems and market access support, and anticipatory action though climate services and forecast-based financing (FbF).

Considering these factors, the WFP’s regional office has adopted a Risk Financing Strategy to facilitate incorporation of inclusive risk finance into sustainable and scalable policies, programmes and partnerships through innovative approaches. Inspired by this strategy, the office of WFP Guatemala designed its own Climate Risk Finance Strategy to strengthen the portfolio of risk-management tools offered to the most vulnerable in the country. This strategy encourages complementarity between different tools including the following:

² The product is awaiting the approval of the Guatemalan supervisory authority, Superintendencia de Bancos (SIB). The local insurer is Aseguradora Rural, the reinsurer is Swiss Re, and the Microinsurance Catastrophe Risk Organisation (MiCRO) supported the technical design of the index insurance coverage.

³ Currently CCRIF is modelling a product to cover drought, a prevalent risk in Guatemala.

- Microinsurance: A weather-index microinsurance product covering drought and excess rain will be integrated into their programmes to boost resilience and productivity from April 2021 onwards². In order to ensure sustainability, WFP Guatemala designed a scalable and sustainable strategy that requires linking the microinsurance product with supply value chains. The product will serve as a stepping stone to enhance access to other financial services, including savings and credit combined with financial education.

- Forecast-based financing: Building on climate-service efforts that already support dissemination of climate forecast information and strengthen inter-institutional agroclimatic round tables, FbF will be developed to provide contingency finance. WFP has already cooperated with the International Research Institute for Climate and Social (IRI) to design triggers for different natural hazards.

- Linkages between macro and meso risk-financing tools: WFP Guatemala is assessing synergies between macro and meso risk-financing tools given that the Government of Guatemala has purchased sovereign coverage against excess rain in the past two years with the Caribbean Catastrophe Risk Insurance Facility (CCRIF)³.

² The product is awaiting the approval of the Guatemalan supervisory authority, Superintendencia de Bancos (SIB). The local insurer is Aseguradora Rural, the reinsurer is Swiss Re, and the Microinsurance Catastrophe Risk Organisation (MiCRO) supported the technical design of the index insurance coverage.

³ Currently CCRIF is modelling a product to cover drought, a prevalent risk in Guatemala.

Women’s Savings Groups in Alta Verapaz who will benefit from the index microinsurance product against drought and excess rain from April 2021 and who will receive assistance to strengthen their capacities to better manage their risks through savings and other formal and informal financial tools available.

Covid-19 impact and response

Like many countries in the region, Guatemala was hit economically by the Covid-19 pandemic, which has exacerbated poverty and food insecurity. The crisis impacted community-level activities and initially affected the ability to gather insights into the financial instruments and overall strategy. However, WFP managed to carry out Focus Group Discussions with farmer associations willing to participate in the pilot through its field monitors and remote technological platforms. The pilot will cover approximately 1,400 individuals participating in WFP programmes, with the majority being women. It is envisaged that the product will cover approximately 50,000 producers in the next four years. Once the lockdown eased, WFP finalized gathering essential information for the design and implementation of the approach.

Very interestingly, the pandemic showed that community-based organizations, such as Voluntary Savings and Loans Associations, which are mainly represented by women, have developed interesting risk-financing mechanisms to cope with the crisis. In one of the communities in Alta Verapaz, women created “emergency management committees” to distribute savings to women whose husbands had lost their jobs due to Covid-19. While this was not initiated by WFP, it shows entry points where communities can be supported to strengthen their informal risk-management tools while enhancing their financial literacy and access to formal financial services that will encourage the adoption of suitable risk-finance instruments.

Summary Table

Overview | |

|---|---|

Risk(s) to be covered | Climate risks, in particular drought and excess rain |

Product/Solution | An integrated layered climate-risk finance strategy including a microinsurance product, FbF and synergies between macro, meso and micro. |

Objective | Supporting vulnerable populations to build their resilience to extreme shocks by facilitating access to risk-finance solutions including index-based microinsurance, FbF and strengthening government capacities to adopt risk-financing tools. |

Beneficiaries | Smallholder farmers and small and micro-entrepreneurs in Guatemala |

InsuResilience Global Partnership Members and their partner organizations/governments | Microinsurance product: WFP in collaboration with Swiss Re (reinsurance coverage), Aseguradora Rural (local reinsurer) and MiCRO (technical design of the product)

FbF: International Research Institute for Climate and Social (IRI) of the Earth Institute of Columbia University.

Potential synergies with macro and meso risk-financing instruments such as the Caribbean Catastrophe Risk Insurance Facility (CCRIF) |

Climate and Disaster Risk Management

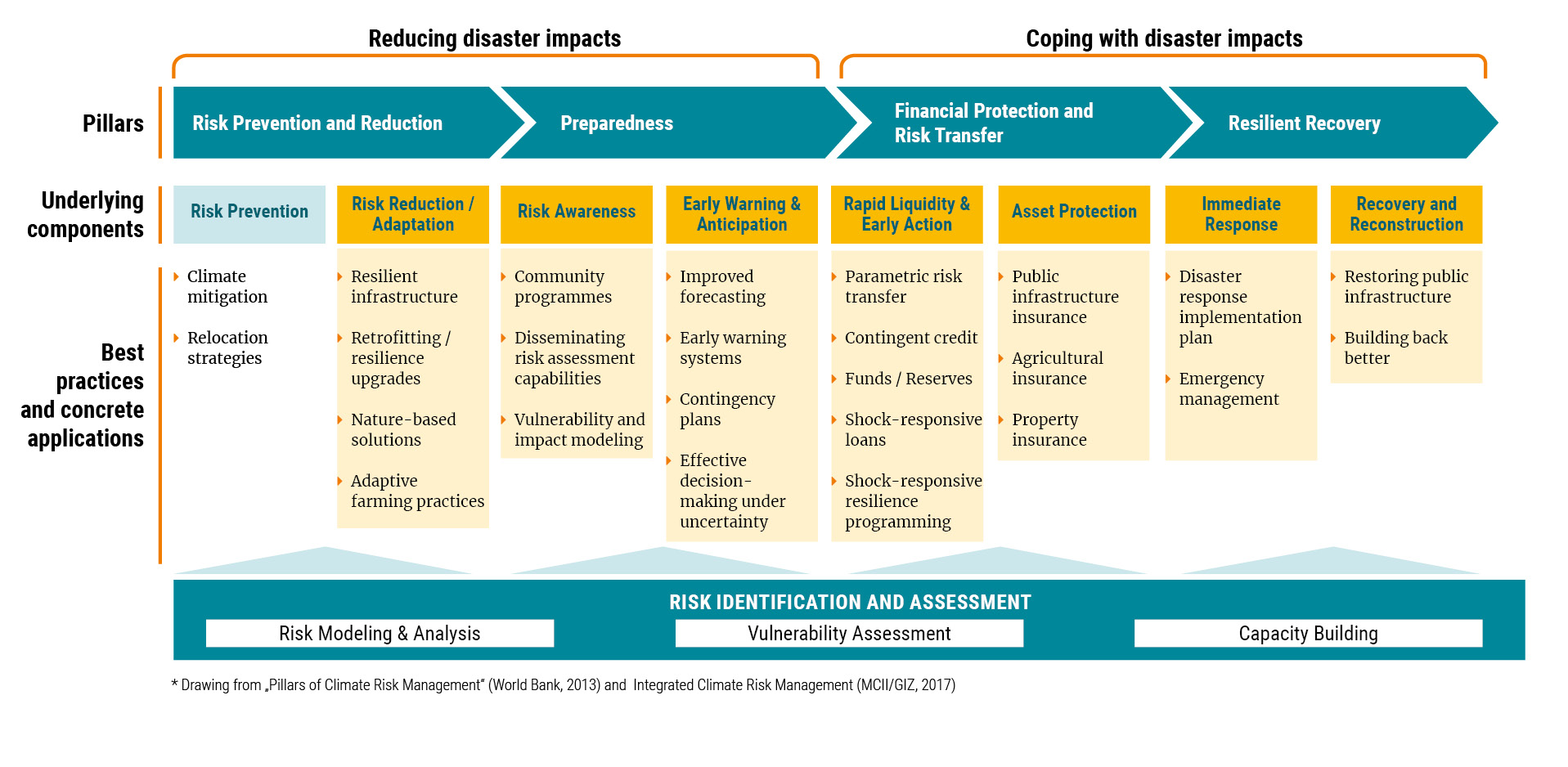

Placement of this project along the climate and disaster risk continuum: