Workstream 2: Action & Implementation

Enable effective action and implementation of high-quality Climate and Disaster Risk Finance and Insurance solutions in poor and vulnerable countries

The World Bank Group’s Global Index Insurance Facility in Zambia

by the world bank group

Smallholder farmers in Zambia are vulnerable to weather-related shocks such as drought, flooding and irregular rainfall. Insurance can be a good risk-management tool for these farmers but the traditional insurance market largely fails to meet their requirement for affordable insurance. Agricultural index insurance provides an innovative and more efficient solution for protecting their crops against losses and encouraging investment. Since 2016, the Global Index Insurance Facility (GIIF) has been working with Mayfair Insurance, a private insurer registered in Zambia, offering capacity building and technical support to the insurance provider. The support enabled the insurer to build its internal capacity for developing and selling weather-based agricultural insurance products to cover vulnerable farmers against weather-related crop losses.

Country Background

Smallholder farmers in Zambia are vulnerable to weather-related shocks such as drought, flooding and irregular rainfall. Insurance can be a good risk-management tool for these farmers but the traditional insurance market largely fails to meet their requirement for affordable insurance. Agricultural index insurance provides an innovative and more efficient solution for protecting their crops against losses and encouraging investment. Since 2016, GIIF has been working with Mayfair Insurance, a private insurer registered in Zambia, offering capacity building and technical support to the insurance provider. The support enabled the insurer to build its internal capacity for developing and selling weather-based agricultural insurance products to cover vulnerable farmers against weather-related crop losses.

The increasing frequency and intensity of droughts and floods occurring in Zambia due to climate change has adversely impacted the livelihoods of 13 million people, with approximately two-thirds of them depending on rain-fed, subsistence farming (USAID, 2016). The insurance penetration was very low in agrarian communities but the government’s decision in 2017 to include weather index insurance on a Farmer Input Support Programme (FISP) e-voucher empowered rapid insurance uptake over a number of years.

Project description

Mayfair works with select aggregators, such as microfinance institutions, farmer’s organizations, agribusinesses and development partners like WFP to reach the target farmers more efficiently. It has also been contracted by the Ministry of Agriculture to develop insurance products that can be bundled together with the government input subsidy package under the FISP. This enables the input subsidy received by each farmer to be protected against loss due to drought or excessive rainfall and improves their resilience. This approach has resulted in the issuance of around three million contracts to approximately 15 million beneficiaries since 2016. The Mayfair programme also benefits from GIIF’s product development support and technical training workshops tailored to the needs of practitioners, regulators and other stakeholders. The objective is increase knowledge and awareness of issues related to agriculture index insurance.

More specifically, Mayfair Insurance and the World Food Programme (WFP) collaborated in the 2018/2019 season to provide insurance coverage for farmers who were part of the WFP’s R4 Rural Resilience Initiative.

The farmers received a bundle of services comprising advisory consultation highlighting farm practices for improving their resilience to climate change,

credit for purchasing improved and drought-tolerant farm inputs (in collaboration with Vision Fund International, a network of microfinance institutions) and insurance for protecting these inputs against losses due to unfavourable weather conditions. They were also given access to other financial products such as savings accounts.

In the following season (2019/2020), Mayfair continued to provide agriculture index insurance to farmers benefiting from the FISP. Farmers in six out of the ten participating provinces were affected by persistent drought in December 2019 and this triggered a claim payout. The payout enabled farmers to purchase inputs for rapidly maturing varieties of the same or other crops, replant them and consequently not miss out on the entire farming season.

GIIF has provided technical training to practitioners, regulators and management levels in all these activities and throughout the overall implementation with Mayfair. It has also offered support on product design, pricing, data collection, analysis and product validation. Training modules have been established and collaboration efforts initiated with other organizations relating to consumer education activities

Covid-19 impact and response

Alongside other African countries where GIIF operates, movement restrictions in Zambia have also caused delays in conducting field visits, farmer training and awareness-raising workshops. Mayfair experienced delays in collecting the outstanding premium owed by the government for insurance services bundled with the FISP in the 2018/2019 season. This was due to budget reallocation to expenditure for Covid-19. However, the premium has since been paid. Policy renewal with key aggregators has not been affected and the insurer expects to retain its interest in the agricultural insurance product.

Covid-19 has reinforced the company’s business continuity plan since all staff have been working remotely from home. Farmers covered under an aggregator partnering scheme with a telecoms company have been able to pay the premium and receive claims through mobile money. Mayfair will work to scale adaptation of its digital platform and employ insurtech solutions wherever feasible on its journey to facilitate recovery from the pandemic.

In view of the low levels of insurance penetration in the country, high priority needs to be given to financial and insurance literacy programmes for farmers. Specific training also needs to be provided on the role and benefits of the different insurance products. GIIF’s implementing partner Mayfair Insurance employs a multifaceted approach, including face-to-face farmer engagement and training delivered to the trainers. It also covers information dissemination through media campaigns, leaflets and farmer mobile phones.

Promotion of FISP-linked weather insurance is additionally included in collaboration with the National Agriculture Information Services of the Ministry of Agriculture. The introductory video on index insurance can be found here.

Mayfair Insurance provides weather index insurance coverage to smallholder farmers through FISP, the Zambia National Farmers’ Union and other local farmer organizations.

Unlike, in the case of traditional indemnity insurance, farmers enrolled under this insurance are able to effectively manage climate risks, enabling investment and growth in the agricultural sector. In this case, payouts are explicitly based on loss measured by means of a weather-based index.

Summary Table

Overview | |

|---|---|

Risk(s) to be covered | Drought |

Product/Solution | Weather index-based crop insurance |

Objective | Developing new agricultural insurance products in the country and collaborating with other stakeholders in the ecosystem (agribusinesses, farmer cooperatives, telecommunication companies, other donor-funded programmes, etc.) to develop the market |

Beneficiaries | Smallholder farmers and their families [approx. three million insurance policies issued, reaching out to 15 million end beneficiaries] |

InsuResilience Global Partnership Members and their partner organizations/governments | Ministry of Agriculture (FISP), the UN’s World Food Programme, Alliance Ginneries, One Acre Fund, Agora Microfinance and Louis Dreyfus Company (formerly NWK). |

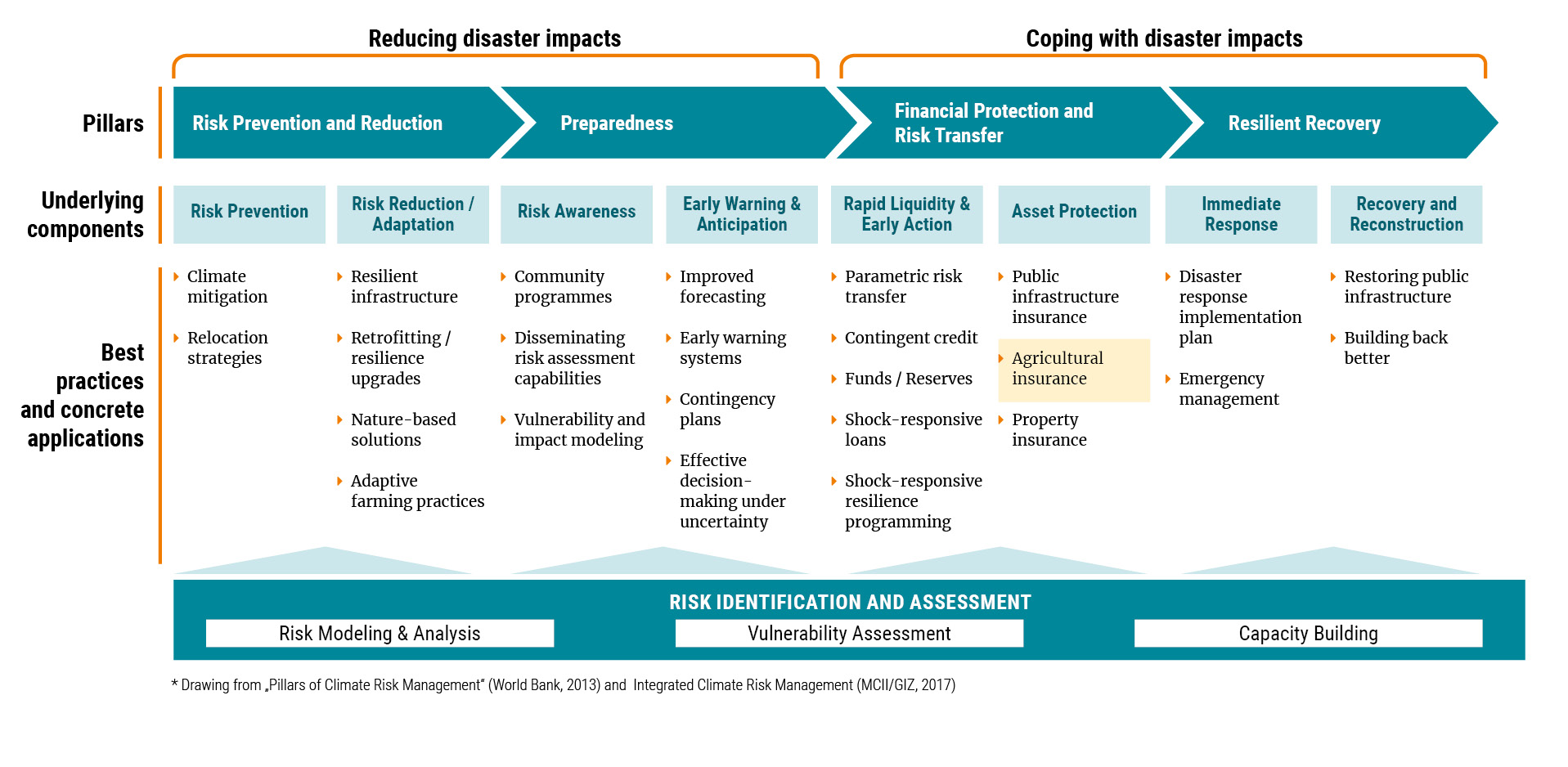

Climate and Disaster Risk Management

Placement of this project along the climate and disaster risk continuum: