Workstream 2: Action & Implementation

Enable effective action and implementation of high-quality Climate and Disaster Risk Finance and Insurance solutions in poor and vulnerable countries

Climate and Disaster Risk Management - Calling for Risk-informed Decision-making

Risk financing and insurance are most effective when they form part of a national, system-wide approach to managing climate and disaster risks. This integration in wider policy is anchored in the Partnership’s Vision 2025, specifically through one of its key target indicators – “increasing the number of countries adopting risk financing and insurance solutions that are integrated within prevention, preparedness, response and recovery plans”. But also two further key target indicators – “increasing value for money and human” and “development impact of climate and disaster risk finance and insurance” – rely on risk-informed decision-making and integrated strategies that take into account trade-offs and interactions among different risk-management options.

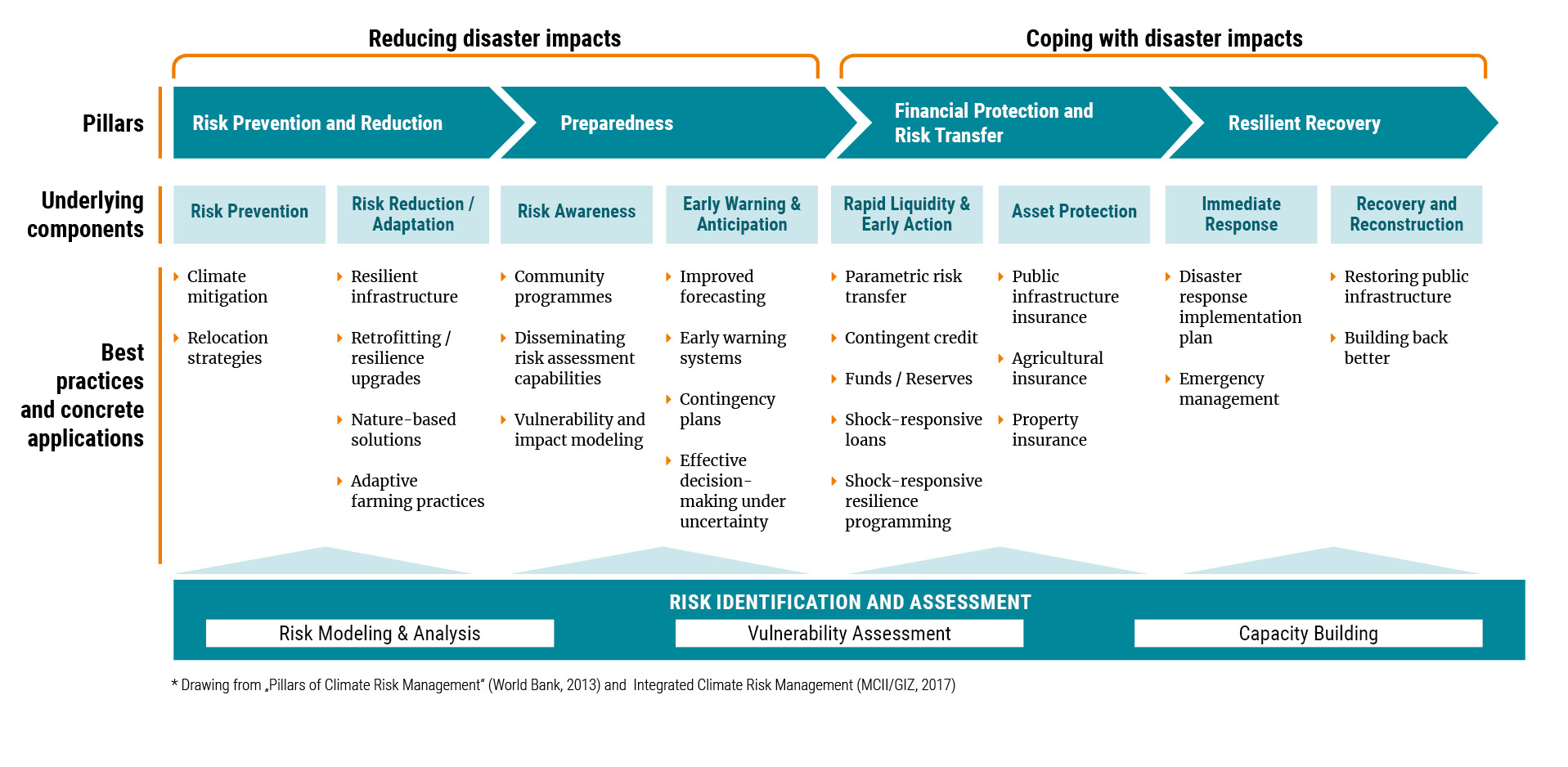

Risk-informed planning requires governments to understand their unique vulnerabilities and the cost-effectiveness of implementing specific measures. Building on sound risk analysis and vulnerability assessments, a comprehensive climate and disaster risk management (CDRM) strategy combines long-term climate adaptation efforts with risk reduction, preparedness and recovery. Its building blocks consist of

- Risk Prevention and Reduction,

- Preparedness,

- Financial Protection and Risk Transfer and

- Resilient Recovery (long-term adaptation).

Investment portfolios which integrate those four areas can work to achieve resilience objectives cost-effectively. This process should engage a wide array of stakeholders, including government planning bodies, the private sector, civil society and development agencies to ensure effective and efficient use of knowledge and resources.

The key value of risk financing and insurance in this process is to absorb residual risks that could not be mitigated cost-effectively through other measures. In addition, having prearranged risk financing on standby supports an earlier and more reliable response to disasters. Governments avoid reallocating scarce resources within the national budget or borrowing on very poor financing terms directly after a disaster.

Within a comprehensive CDRM approach, economic risk modelling helps to identify cost-effective risk prevention and reduction options and their trade-offs up to a point at which they become prohibitively expensive, and risk financing proves more feasible. On that basis, risk-finance instruments can then be identified and combined following a risk layering approach. This ultimately helps to identify those combinations of risk-management measures that come with the lowest overall costs while maximizing resilience.

For more information on how the InsuResilience Global Partnership promotes comprehensive CDRM, refer to the case studies of this Annual Report. At the end of each case study, the CDRM model is included to point out where the respective projects are placed along this process. The following overview shows how the case studies are arranged according to the four CDRM building blocks. It is apparent that many of the projects described in the case studies span across several building blocks, which underlines the comprehensive nature of the solutions across the Partnership.