Workstream 2: Action & Implementation

Enable effective action and implementation of high-quality Climate and Disaster Risk Finance and Insurance solutions in poor and vulnerable countries

InsuResilience Solutions Fund - Development of an Insurance Programme for Public Schools in Peru

by the InsuResilience Solutions Fund

The InsuResilience Solutions Fund (ISF) is co-funding an innovative insurance approach in order to strengthen the resilience of Peru’s public schools to natural disaster risks. The programme is being promoted by the Peruvian Association of Insurance Companies (APESEG) and a project consortium formed by the Insurance Development Forum (IDF). It facilitates a faster reconstruction process and resumption of schooling. This marks the first public-private partnership project under the Tripartite Agreement between the German Government, IDF and the United Nations Development Programme (UNDP) to support risk-management solutions for climate-vulnerable countries.

Country Background

Peru is exposed to a variety of natural hazards, including earthquakes, tsunamis and heavy rains that result in devastating floods and landslides. Their frequency, severity and impact are exacerbated by the El Niño effect and climate change.

These climate risks threaten recent advances in Peru’s development, particularly among the vulnerable population. The 2017 El Niño Costero flooding in Peru was extremely destructive and exerted catastrophic effects on the country and its public infrastructure.

Furthermore, a low level of insurance distribution across the country left people in a vulnerable position with little financial protection. As a consequence, significant investment was required from the government to address the damage caused. More than 1,000 public schools had sustained damage as a result of El Niño Costero and rebuilding was not carried out until three years later. Administrative hurdles and limited capacities represent major obstacles for the swift reconstruction and repair of public infrastructure.

Project description

The Frankfurt School of Finance and Management – as the implementing agency of the ISF – signed a grant-funding agreement in September 2020 with the IDF project consortium partners. This agreement was intended to strengthen the resilience of the portfolio of more than 50,000 public schools in Peru to natural disaster risks. Led by AXA XL and Munich Re, two members of the InsuResilience Global Partnership, the consortium includes APESEG as a critical local partner. The ISF co-financed a dedicated feasibility study last year to substantiate the political, technical and legal viability of the insurance approach. The new national insurance programme for public schools providing protection against natural hazards will be jointly designed by the (re)insurance companies AXA XL and Munich Re, alongside the catastrophic risk modellers GEM Foundation and JBA Risk Management. This design process will include input from local insurance companies.

The start of the Peruvian Public Schools project marks the first venture under the Tripartite Agreement between the German Federal Ministry for Economic Cooperation and Development (BMZ), the IDF and UNDP. The agreement was signed at the United Nations Secretary General’s Climate Action Summit in September 2019.

The ISF is funded by the German Development Bank (KfW) on behalf of the BMZ and it is one of the vehicles used to support implementation of the joint agreement.

As part of this project for the Peruvian Government, the insurance programme acts as a catalyst for providing comprehensive risk management. Ex-ante formulated financing and reconstruction procurement processes for public schools are intended to enable a faster start for reconstruction and help to improve school building standards over the long term. The use of innovative image-recognition technologies offered by insurtech Picsure enables faster documentation and value assessment of assets to be insured and more cost-efficient assessment of claims.

As a result, the resilience of public schools in Peru against major climate and geophysical risks will be enhanced and pupils and school staff throughout the country are expected to benefit indirectly from improved and secure school buildings and a faster resumption of schooling that will minimize interruption to education.

“The chance that this project provides to consider alternative options for an insurance solution, developed by global reinsurance companies in partnership with APESEG, is extremely valuable for Peru. It will allow the Government to make choices that can help it to increase its resilience to catastrophic events.”

Eduardo Morón Pastor, President of APESEG

Covid-19 impact and response

The Covid-19 pandemic has affected the project’s progress on a political level as a result of political unrest and change in contact persons at the ministries. There may be additional impacts at the technical level as well. The project team is adapting to the current situation by engaging in regular exchange with the project consortium, which in turn communicates regularly with the government. On the technical level, the preparation of regular risk assessments has proved helpful in identifying, assessing and mitigating possible negative impacts on the timely implementation of the programme.

Peru was featured as a case study for the Latin America and Caribbean Region session during the InsuResilience Annual Partnership Forum 2020. More insights on Peru’s strategies and initiatives are provided in the recording of the session below: video 1 and video 2.

Summary Table

Overview | |

|---|---|

Risk(s) to be covered | Multi-risk (incl. flood, heavy rainfall, earthquakes, tsunami, etc.) |

Product/Solution | Indemnity-based insurance (professional loss adjusters supported by innovative image-recognition tools to determine losses) |

Objective | Development of a new insurance programme for public schools in Peru to enhance their resilience against natural disaster risks.

Insurance payouts will be used for reconstruction and repair works.

|

Beneficiaries | School staff and pupils of public schools, parents

(6,000,000 indirect beneficiaries by 2025)

|

InsuResilience Global Partnership Members and their partner organizations/governments | A project consortium convened by the Insurance Development Forum which includes its members AXA XL, Munich RE and JBA Risk Management, as well as the GEM Foundation, insurtech Picsure and the Peruvian Association of Insurance Companies (APESEG), in cooperation with the InsuResilience Solutions Fund, funded by the German Development Bank (KfW) under its mandate from the BMZ. |

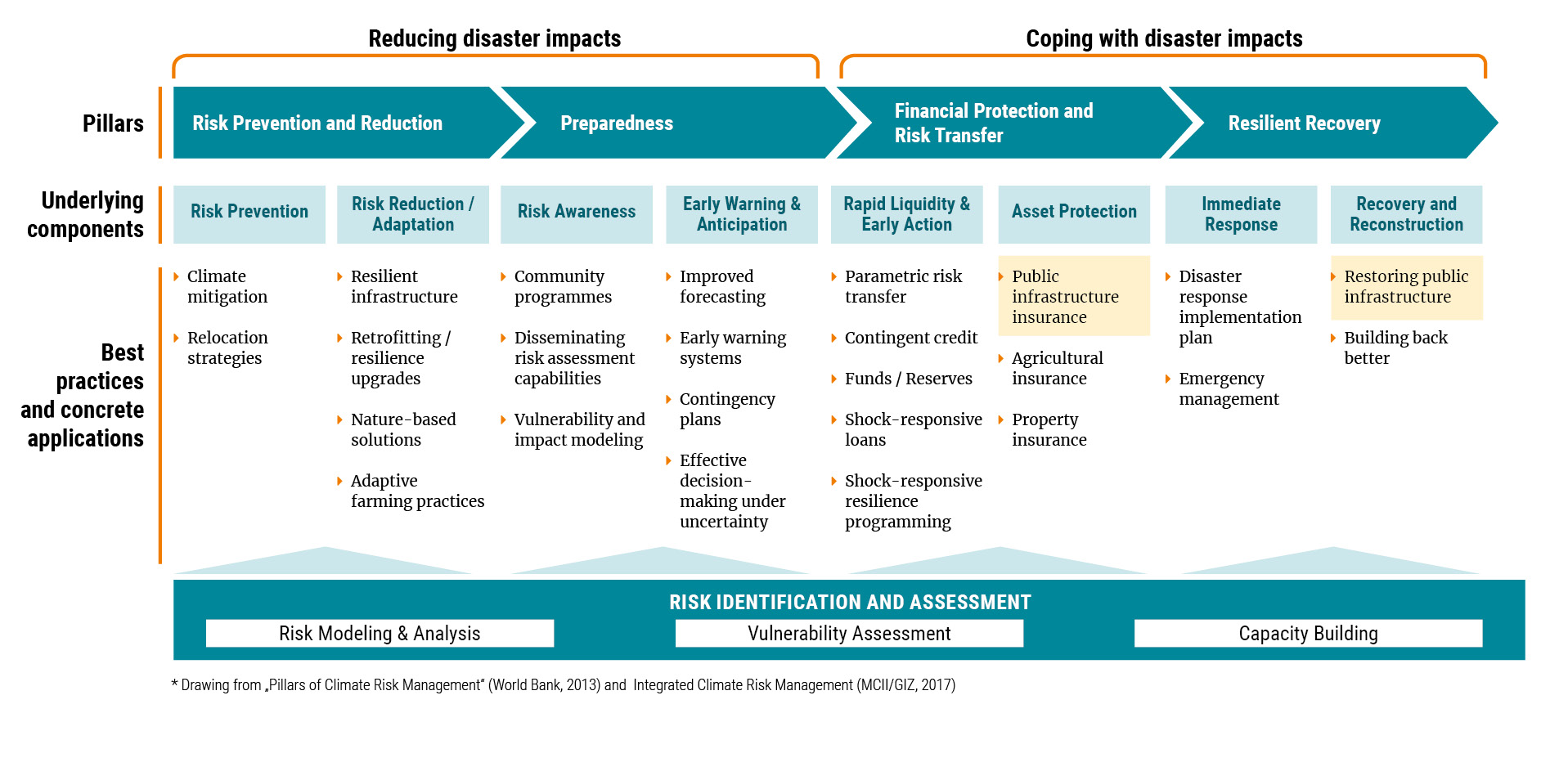

Climate and Disaster Risk Management

Placement of this project along the climate and disaster risk continuum: