Intro

InsuResilience at a Glance

VISION 2025 - KEY TARGET INDICATORS

Reached in 2020

Targets by 2025

Million poor and vulnerable People covered ANNUALLY BY CLIMATE AND DISASTER RISK FINANCE AND INSURANCE SOLUTIONS

500

Million poor and vulnerable People covered annually by microinsurance

150

Countries with comprehensive disaster risk finance strategies in place

80

Countries with microinsurance solutions

70

Countries with (SUB-)SOVEREIGN RISK FINANCING AND INSURANCE SOLUTIONS

60

More information on the Partnership’s M&E Framework

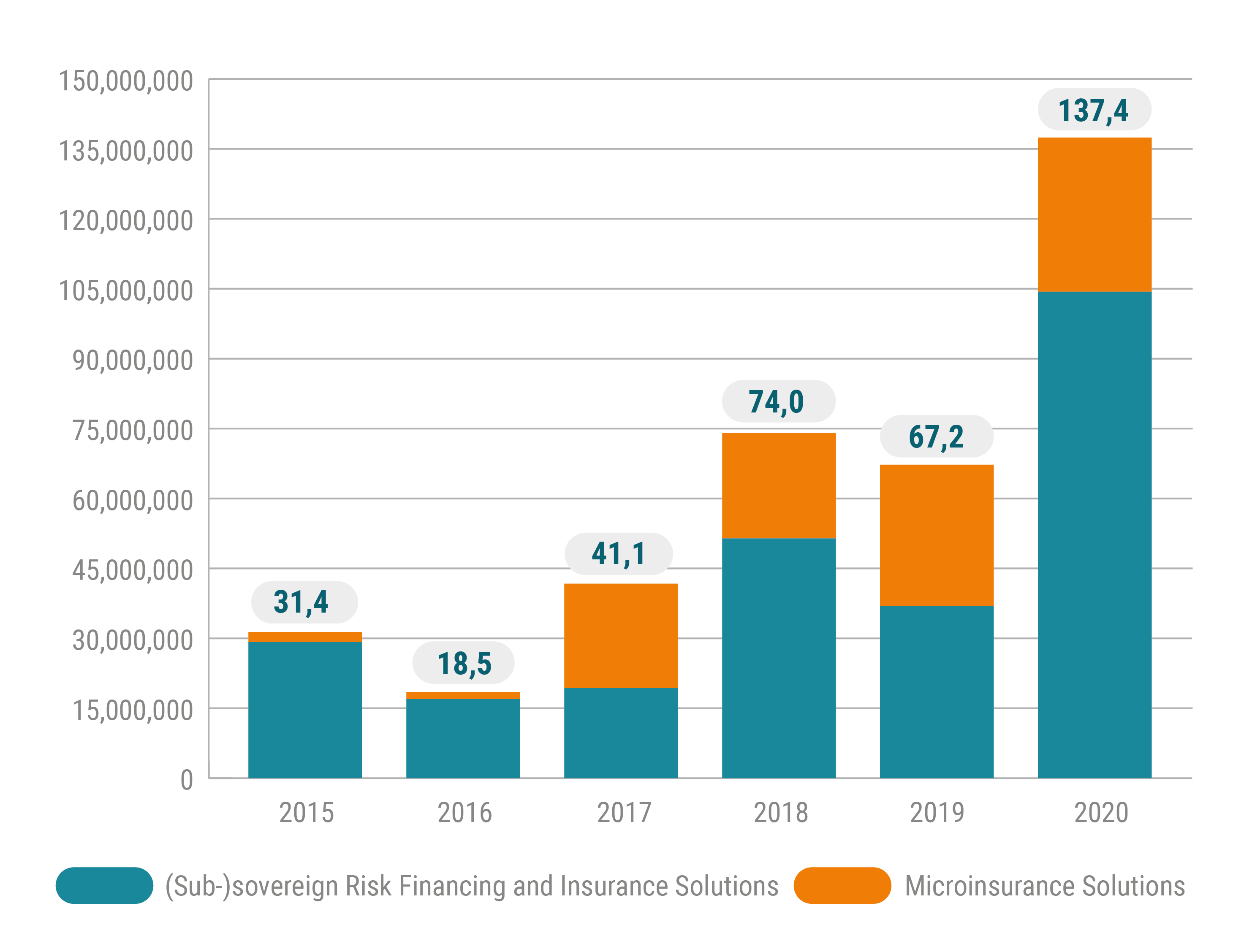

Beneficiaries over time

Annual beneficiaries under the Insuresilience Global Partnership

INSURESILIENCE G7 TARGET

2020 marks the final year for the G7 InsuResilience target of 2015, according to which up to 400 million people in the most vulnerable developing countries should gain access to financial protection against climate-related hazards by 2020. The number of people protected under the G7 InsuResilience Initiative and the InsuResilience Global Partnership has grown strongly since 2015. Between 2015 and 2020, joint efforts under the Partnership in total enabled access to financial protection for over 350 million people in vulnerable countries. In 2020 alone, 137 million poor and vulnerable people benefitted globally from active Climate and Disaster Risk Finance and Insurance (CDRFI) solutions currently being implemented by programmes under the Partnership. This represents a significant increase compared with just over 30 million in 2015.

As part of the ambitious and further developed commitments under Vision 2025, the Partnership aims to provide 500 million poor and vulnerable people annually with financial coverage through CDRFI by 2025. Currently, 22 programmes with 218 projects in 101 countries that contribute to the Partnership’s vision are already active or in development. With many solutions becoming active over the coming years, and existing risk pools and insurance schemes expanding, the number of people benefitting from solutions under the Partnership is expected to grow significantly going forward.

Programmes and Risks covered

with

in

covering...

More information on InsuResilience Programmes

Success Stories

The Carribean Catastrophe Insurance Facility (CCRIF)

Payout Haiti: USD 7.2 Million

In 2020, Haiti was hit by Tropical Cyclone Laura. More than 44,0000 people were adversely affected by heavy rainfall, and more than 6,000 homes flooded. In consequence, the country’s Excess Rainfall parametric insurance policy with the Caribbean Catastrophe Risk Insurance Facility (CCRIF) was triggered and Haiti received a payout of approximately USD 7.2 million to enable quick relief.

CCRIF has made payouts amounting to USD 170 million...

... in 45 payouts since 2007.

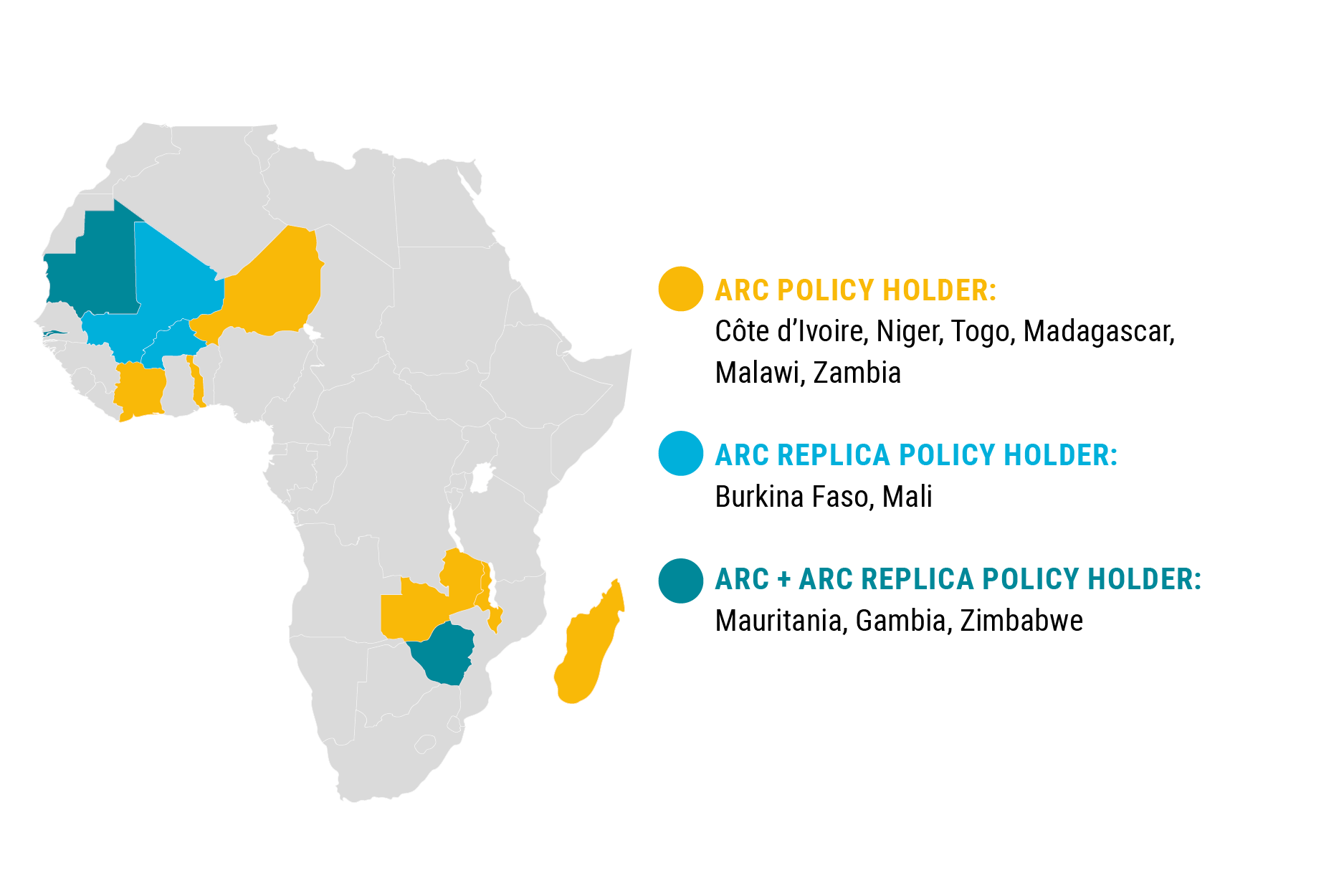

MoreAfrican Risk Pool (ARC): Recent growth for ARC & ARC Replica insurances

ARC & ARC Replica policy holders 2020/21 in 11 African countries

Payout Senegal: USD 23 MILLION

The Government of Senegal and the Start Network have in total received USD 23 million through ARC and ARC Replica insurance payouts. USD 12.5 million were received by the Government and USD 10.5 million by the Start Network. They had acquired the insurance policy in summer 2019 and the payout was triggered at the end of 2019 due to a drought. The payout and implementation became effective in 2020, benefitting about 400,000 people with food and cash distributions, as well as nutrition activities and subsidized cattle feed.

ARC & ARC Replica payouts and impact

ARC & ARC Replica payouts and impact

Payout Madagascar: USD 2.13 Million

One of the InsuResilience Global Partnership’s members, the Government of Madagascar, received USD 2.13 million by ARC through the drought insurance product in July 2020 responding to crop failures.

More information on ARC Replica

Africa Asia and Americas Resilience in Disaster Insurance Scheme (ARDIS) PAYOUTS MYANMAR, VIETNAM, HONDURAS

ARDIS is currently the world’s largest non-governmental climate risk insurance programme. In 2020, it activated four times: 1) Flooding in Central Myanmar, 2) Seasonal drought in the North and South of Myanmar, 3) Tropical Cyclone Vamco in Vietnam and 4) Hurricane Iota in Honduras. In total, it provided a direct capital payment of USD 315,000 from the Natural Disaster Fund and access to up to USD 3,950,000 of a contingent credit facility provided by the InsuResilience Investment Fund.

More information on ARDIS

COVID-19 and the InsuResilience Global Partnership

The Partnership’s High-Level Consultative Group endorsed the need for a multi-dimensional view on risk in Climate and Disaster Risk Financing and Insurance practice, including pandemic perils.

Of the 22 implementing programmes under the Partnership, 11 already offer pandemics solutions and products or already have such a solution in their project pipeline.

In response to the pandemic, CCRIF offered a 50% reduction in premium costs on their parametric insurance policies or an increase in coverage at no additional cost to support Central American countries and the Dominican Republic.

Germany stepped in with its emergency Covid-19 support and assumed premium payments of around EUR 19.5 million for the drought insurance offered by ARC. This protects up to 20 million poor and vulnerable people in Africa.

InsuResilience Global Partnership community

Members and Partners

93 Members

High-Level Consultative Group

Collaboration through thematic Working Groups

- New Evidence Roadmap

- New M&E Framework

- M&E Terminology

- About 35 active members

- Two LIVE TALKS on Gender and Climate Finance in cooperation with FARM-D and IFAD:

- Launch of the Centre of Excellence for Gender-smart Solutions

- More than 20 members

- Two web-talks

- Risk-Financing and Nature-based Solutions: Linkages and Opportunities for Integrated Approaches

- Early Warning Systems and Risk Financing: Opportunities for Enhancing Anticipatory Action

- Launch of four Sectoral Communities

- More than 35 members